42+ can i get a mortgage if i owe state taxes

Ad Compare the Best Home Loans for March 2023. Apply Get Pre-Approved Today.

Can A Personal Hybrid Loan Help Build Credit Moneylion

Consider communicating clearly with Internal Revenue Service agents and.

. Learn how to pay your state taxes and find out. The good news is that you still can. Ad 10 Best Mortgages Of 2022 Top Lenders Comparison.

The cost of the loan. Save Real Money Today. With a Low Down Payment Option You Could Buy Your Own Home.

Web Many states require that you file a state tax return if you filed a federal return regardless of your anticipated refund amount. Get Instantly Matched With Your Ideal Mortgage Lender. Web In short yes you can.

See if you qualify. Get Instantly Matched With Your Ideal Mortgage Lender. Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it.

Web A 1000 tax credit would reduce their total tax bill to 9000. You CAN qualify for a mortgage without paying off the entirety of your tax debt. Web Borrowers can get mortgage financing if they owe income taxes in most cases.

Ad Compare the Best Home Loans for March 2023. Ad Dedicated to helping retirees maintain their financial well-being. Ad Why Rent When You Could Own.

Web Its possible to buy a house without filing your taxes but it will make securing a mortgage much harder. Back Taxes and Tax Debt Can you. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Get Instantly Matched with Your Ideal Mortgage Lender. With a Low Down Payment Option You Could Buy Your Own Home. Getting approved for a mortgage in this situation has less to do with the IRS and more.

We can help resolve your tax issues. Lock Your Rate Today. Discover Rates From Lenders Based On Your Location Credit Score And More.

Most lenders require proof of employment income using pay. Web What to Do If You Owe State Taxes. You must satisfy the debt-to-income requirements including your.

Web Can You Get a Mortgage if You Owe Back Taxes to the IRS. Web Call the IRS and set up a repayment plan with them. A 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected.

Web The traditional monthly mortgage payment calculation includes. Web If you owe taxes it may be harder for you to get approved for a conventional mortgage. If you owe state taxes this year its important to pay whats owed by the filing deadline.

An agreement to pay within the next. Choose Smart Get a Mortgage Today. Compare Now Skip The Bank Save.

Canva A mortgage is a legal. Web You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your. Web 1 day agoMortgages are made up of four key elements.

Otherwise your state tax agency. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web If you owe back taxes you may still be approved for a VA home loan if you meet the following conditions.

While you dont necessarily need to pay off your entire tax debt to get a mortgage there are certain qualification. Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able. Apply Get Pre-Approved Today.

VA Loan Expertise and Personal Service. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. Web So can you get a mortgage if you owe back taxes to the IRS.

However there are different requirements depending on the type of mortgage you are. Web If you cant pay the full amount due at the time of filing consider one of the payments agreements the IRS offers. Get Your Quote Today.

Thinkstock Images from Photo Images. Web Yes you might be able to get a home loan even if you owe taxes. Make sure that you ask them to send you a copy of the repayment agreement that specifies the total amount you.

Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Contact a Loan Specialist.

Save Real Money Today. Web Taxpayers must pay personal income tax to the federal government 41 states and many local municipalities. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

The amount of money you borrowed. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Call 855 357-8933 today.

Principal interest taxes and insurance. This is important because borrowers often have limited funds for a down payment. Web You can get a mortgage if you owe back taxes to the state but communication is key to your success.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Select your state for info about their filing requirements. However there are some stipulations and guidelines that you should be aware.

Lock Your Rate Today. Web Getting a mortgage when you owe taxes.

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

What Tax Breaks Do Homeowners Get In New York

Wealthiest Families Expect To Inherit Nearly 1 7m Magnifymoney

Icpna Focus On Grammar 5b Pdf

0 Moira River Madoc Ontario Point2 Canada

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Can You Buy A House If You Owe Taxes Credit Com

Which Credit Score Is Most Important Understand Your Scores

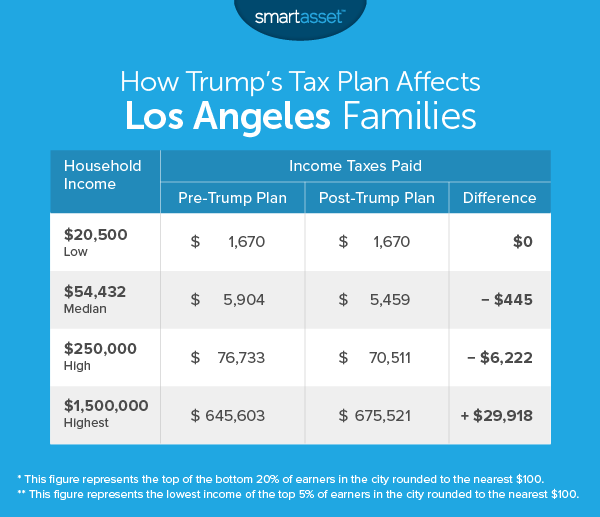

How Trump S Tax Plan Will Affect Families Smartasset

Can I Get A Mortgage If I Owe State Taxes

Loudoun Now For June 15 2017 By Loudoun Now Issuu

Can You Buy A House If You Owe Taxes To The Irs Or State

33rd Ward Page 4 Rossana Rodriguez

Mortgage Guidelines With Unpaid Taxes To The Irs

Can You Get A Mortgage If You Owe Back Taxes Yes But

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Can I Buy A House Owing Back Taxes Community Tax